Traditional Value Stocks

As a brief reminder Investopedia describes value investing as "An investment strategy that involves buying stocks that appear underpriced relative to their intrinsic value."

Originating in the 1920s at Columbia Business School by Benjamin Graham ("The Father of Value Investing") and David Dodd, value investing was originally conducted by purchasing stocks when they traded at a discount to book value or tangible book value, had high dividend yields, and had a low price-to-earnings multiple or price-to-book ratio. This process often relied on purchasing beaten up businesses which held value un-noticed by the average investor, typically referred to as "the cigar butt approach".

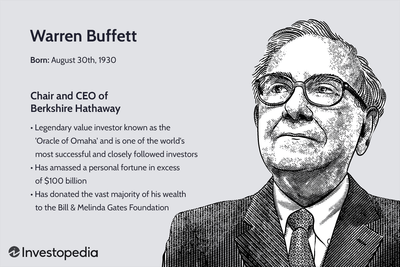

As the world of business moved from asset heavy manufacturing to service based industries the value investing philosophy pioneered by Graham and Dodd evolved. This evolution took many forms however the most followed practice is that of Warren Buffett ("The Oracle of Omaha") and Charlie Munger. Warren, being a student of Grahams, working with Munger realised that times had changed and began a new school of thought for value investing "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." - Buffett.

This school of thought has worked wonders for Buffett and Munger and has been adopted by many value investors to date. Whilst the philosophy of each investor is the same (looking for 50cent Dollars) the approaches vary. How do you assess a company? Is it a wonderful business? Can I buy it for a fair price, or better a discount?

What to look for

Whilst the definition of a wonderful business is very much up for debate there is no argument that

assessing a business comes in 2 stages; quantitative and qualitative.

Quantitative assessment is the process of looking at the financial statements of a business to identify its financial strength and potential for growth. Whilst we are looking at numbers, their interpretation is in the eyes of the investor. The phrase "the art of investing" refers to art, not science, whilst we are looking at the numbers behind a business it is down to each investor to determine what they mean. There is no hard and fast rule.

Qualitative assessment is the process of understanding the business beyond it's numbers. Reading the company's annual reports; understanding the company's plans for the future; what challenges does it face; and what are the bear (bad) and bull (good) cases for the company's future and its growth prospects. Again, investing is an art not a science.

To understand more about my interpretation and views on company analysis please refer to the articles entitled Numbers We Like To See, Beyond The Numbers and Final Thoughts.

How does this fit into the AVI Strategy

Whilst value investing takes a number of forms, this type of investing has been entitled within this strategy "Traditional Value Stock", as it focuses on the principles coined by The Father of Value Investing and The Oracle of Omaha themselves.

Each investment opportunity is assessed on its own merit, including the perceived risk associated. With each stock analysis, a portfolio weighting is assigned based on it's merits and risk. This portfolio weighting is targeted between 2-5% for each stock depending on the investors conviction for each stock. Whilst this could fill the portfolio, high standards should be held during each assessments. Therefore, due to the high standards upheld it should be difficult to identify these types of investment opportunities and Traditional Value Stocks will typically make up 15-25% of the entire portfolio (but never more than 45%).